Retirement Planning

Jeremy Ko

Ph.D.

Dec 19, 2025

When Should You Claim Social Security Retirement Benefits?

Ever wonder when to claim Social Security? The timing can mean thousands in lifetime benefits. Here's what you need to know about claiming in 2025—from FRA changes to new earning limits.

Deciding when to claim Social Security retirement benefits is a big, important decision that requires careful thought and consideration. These benefits can represent a big chunk of retirement income – currently offering up to around $5000 per month ($60,000 per year) in lifetime income for an individual.

Retirement benefits can be claimed as early as age 62. Personal benefits max out at age 70, while spousal benefits max out around age 67 (depending on the recipient’s birth year). Claiming at earlier ages gives you payments that start earlier but are lower per month. Claiming later in life gives you payments that start later but are higher each month. For example, suppose someone had a personal benefit of $2000 per month at their full retirement age (FRA; age 67 for anyone born in 1960 or later). That person would earn $1400 per month in real terms (i.e., in terms of purchasing power) if they claimed at age 62. They would earn quite a bit more – $2480 per month – if they waited until age 70 to claim. You can view the effects of early or delayed retirement benefits here.

What are some factors you should consider when deciding when to claim Social Security benefits?

Financial needs and resources

Some people claim their benefits at their earliest eligible age (e.g., age 62) due to financial need. They may be unemployed or underemployed. They may have chosen to retire. They may be facing large expenses. I recall advising a couple who wanted to claim their Social Security benefits early to build an emergency fund. They wanted these savings because the husband was self-employed and experienced large swings in income from year to year. The need for a rainy-day fund can be a perfectly legitimate reason for wanting to claim early.

Expected lifespan

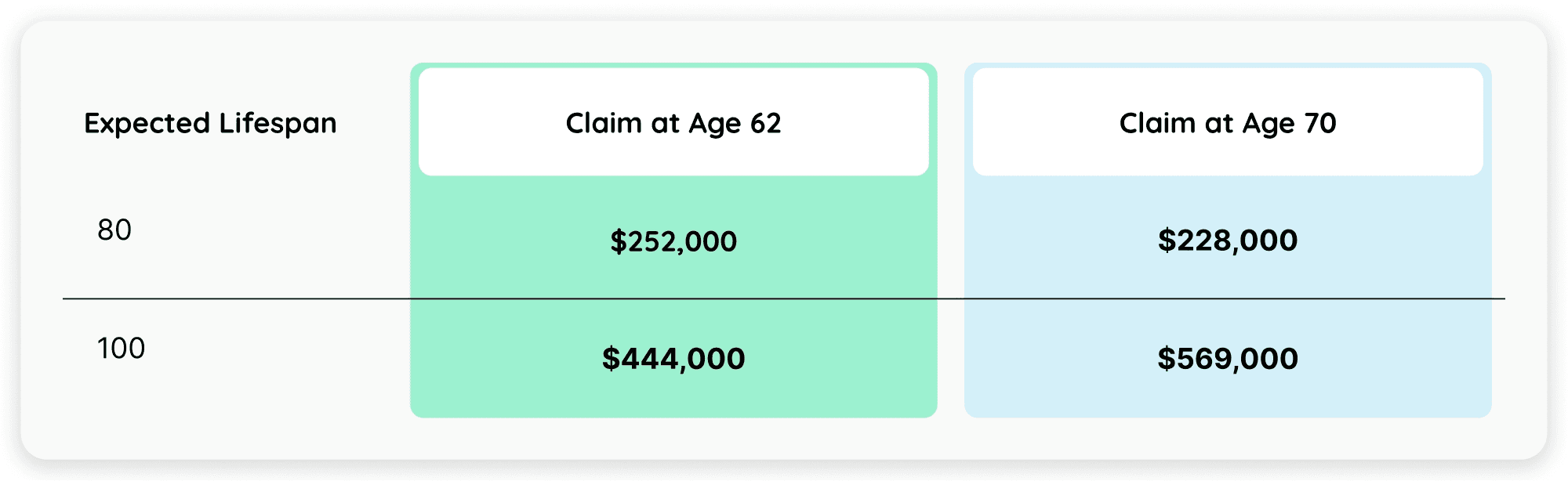

All else equal, people with longer expected lifespan would benefit from claiming later (e.g., age 70). These people benefit more from a higher monthly payment because they expect many payments over the course of their lives. People with shorter expected lifespans would benefit from claiming earlier (e.g., age 62). These people don’t want to miss out on their early benefits because they expect fewer payments over a lifetime. The table below shows the present value of benefits for two possible claiming ages (62 and 70) and two possible lifespans (80 and 100) when the person’s benefit at their FRA is $2000 per month.

One can see that claiming at age 62 results in a higher total value than claiming at age 70 with a short expected lifespan of 80. However, claiming at 70 beats claiming at age 62 if this person has a higher expected lifespan of 100 because this person is expecting so many more monthly payments. In fact, claiming at age 70 beats claiming at age 62 for lifespans starting around 82 years old (which is slightly lower than the median lifespan for people in the US at age 62).

You should keep in mind that the analysis above doesn’t account for survivor benefits! The higher earner in a married couple can generally pass their Social Security benefit along to their spouse upon death. Therefore, this benefit can last beyond the lifespan of any one spouse. For this reason, it generally makes sense for the higher earner in a married couple to delay claiming until age 70.

Consider using this free online Social Security calculator, which provides information on the value of claiming at different ages based on your expected lifespan.

Employment situation

Earning income from work before full retirement age can result in penalties on any Social Security payments before the full retirement age. Any income above the current limit of $23,400 results in reductions in Social Security payments, which are then paid back after your FRA. As a result, it might make sense to delay social security benefits until after you retire or reach your FRA (whichever comes first).

Effect on other family benefits

Claiming Social Security retirement benefits can affect the benefits that may be received by other family members. For example, an individual may become eligible for spousal benefits once their spouse has claimed their benefits. Therefore, it might make sense to claim early to allow your spouse to claim their spousal benefits. This kind of strategy can work well when one or both spouses have a short expected lifespan.

As mentioned, the amount of your benefit can also affect the survivor benefit available to your spouse if you pass away first. Therefore, it might make sense to claim late so that your spouse gets a larger survivor benefit, as mentioned previously.

Effect on other government benefits

Several government programs have eligibility based on income, including SNAP food benefits and Medicaid. Income from Social Security can affect eligibility for these programs. In addition, income from Social Security can affect Medicare premiums through the IRMAA penalty. It might make sense to claim Social Security benefits to minimize these penalties strategically. For example, it might make sense for someone to claim Social Security early and opt for a lower benefit if a higher benefit can make them ineligible for Medicaid.

Taxes

You should think about maximizing your after-tax income. Your social security income is taxable above certain limits (e.g., $25,000 of “provisional income” for individuals and $32,000 for married couples filing jointly). In addition, your social security income can affect the tax rate on the rest of your income. Again, it might make sense to claim Social Security benefits strategically to minimize the impact on your taxes.

For example, suppose that you plan to work until age 70. In this case, social security benefits can be taxed at higher marginal rates while you’re working. It might make sense to delay your benefits as a result. A professional tax preparer can provide more insights into these issues.

In summary, there are a number of factors you should consider when deciding when to claim Social Security. You may want to consult a financial professional when making such a complex decision with potentially significant implications for your financial well-being in retirement.

Editorial Note: The information in this article, including Social Security benefit amounts, earnings limits, and tax thresholds, is accurate as of December 2025. Social Security rules and dollar amounts are subject to annual cost-of-living adjustments (COLA). For the most current information about your specific situation, please visit SSA.gov or consult with a qualified financial advisor.

About the author

Jeremy Ko

Ph.D.

K. Jeremy Ko has been working in the area of financial education, planning, and research for over twenty years. He has focused on retirement and social security planning for almost 15 of those years. He has a passion for helping people achieve lifelong financial security. His educational and professional credentials include a PhD in financial economics from the MIT Sloan School of Management, an academic teaching/research position in the finance department of Penn State’s Smeal School of Business, and a leadership position at a top-ranked independent financial advisory firm - Edelman Financial Engines.