Budgeting + Spending

Stephanie Cote

CFEI®, CFEd®, Trauma of Money Certified Practitioner, HUD Housing Certified Counselor

Feb 6, 2026

How Stress Hijacks Your Spending Decisions (And What To Do About It)

Ever buy things after a stressful day you wouldn't normally purchase? The Triune Brain theory might explain why. Learn how stress hijacks your spending decisions and what you can do about it.

Ever find yourself clicking "buy now" after a terrible day, only to feel regret when the package arrives? You're not imagining things—your brain actually processes money differently under stress. And understanding this isn't about shame or blame. It's about recognizing the patterns so you can make choices that align with your actual goals, not just your stress levels.

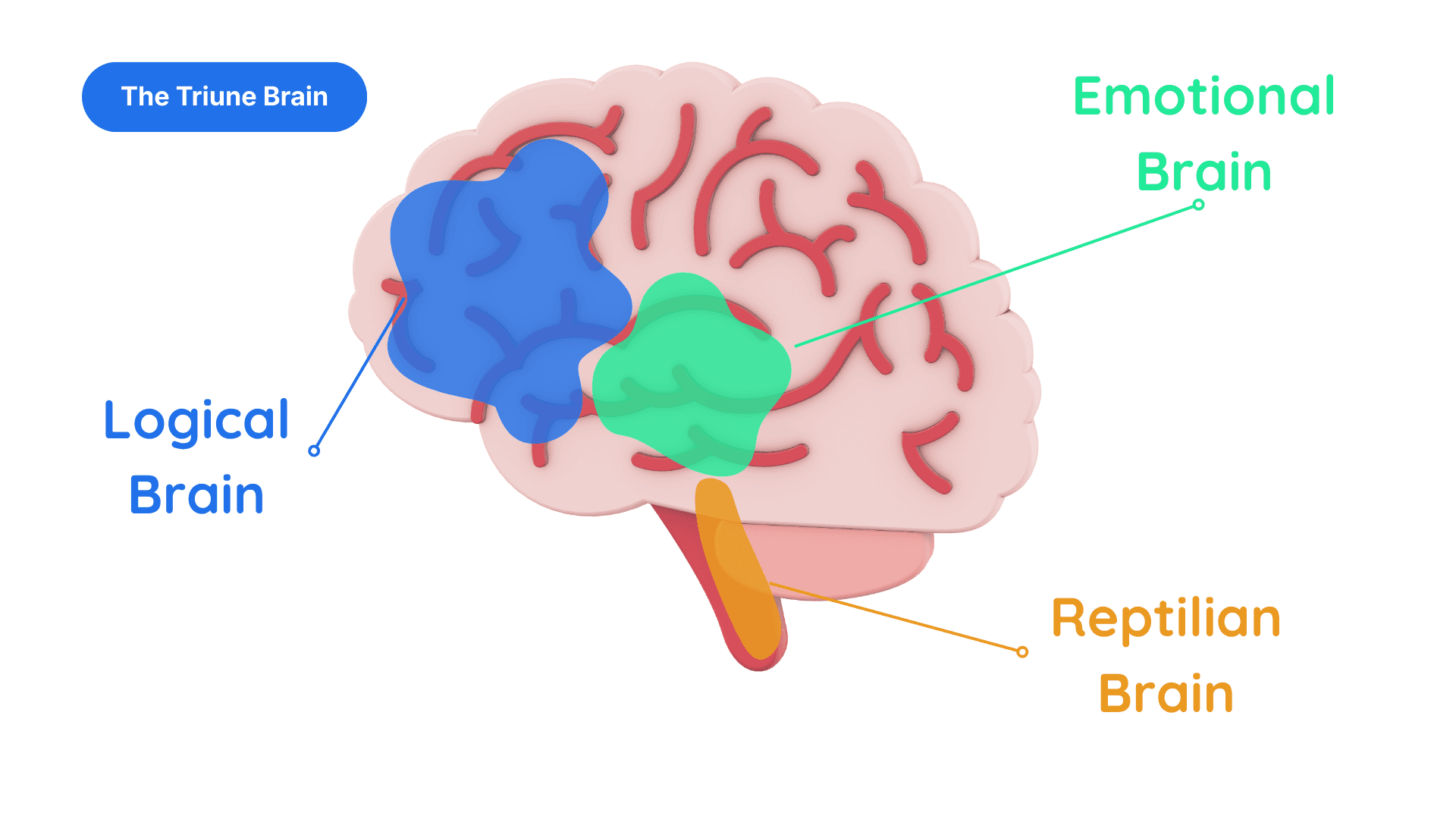

The Triune Brain is a psychological theory that looks at brain region groupings and reactions that happen in those regions. This article explores this theory and how it applies to purchasing decisions, especially under stress. Disclaimer: This is a high-level framework that describes what is happening in the brain at a macro level. Please do not leave reading this article thinking that it has any representation of the complexities happening within the brain from a neurological standpoint. Understanding these patterns can help you make more intentional choices that align with your values. When you recognize which part of your brain is driving your financial decisions, you gain the power to pause, reflect, and choose differently. This awareness is the foundation for building healthier relationships with money.

In the triune brain theory, the model of the brain is in three pieces: the reptilian brain, the emotional brain, and the logical brain. Let's dive in and see what each of these pieces represents.

What is the logical brain (neocortex or prefrontal cortex)?

The logical brain or prefrontal cortex, is where we process situations logically in an executive state, and can ask "What can I learn from this?" Our prefrontal cortex is fully developed around age 25. This is why teenagers can seem like they view themselves as invincible and take more risks. They aren't able to fully process situations with the fully developed logical processing part of the brain.

Purchasing with the emotional brain (limbic system)

The emotional brain is where we access feelings and can ask, "Am I loved and accepted?" The emotional brain can be triggered in various ways through marketing and sales tactics. The emotional brain is rooted in feelings of connection, belonging, and approval. Remember the last time you impulsively purchased something because the advertisement pulled at your heartstrings? Or the persuasive salesperson who overloaded you with personal compliments, clouding your judgment, and you walked away second-guessing your purchase. The world of consumerism uses marketing techniques that bypass use of your logical brain for your purchases. When you are in a heightened emotional state, your ability to logically calculate your purchasing decisions is often reduced. In a calm, relaxed, clear state, a consumer might not otherwise make those impulsive purchases.

The fight, flight, fawn, and freeze reaction from the reptilian brain (basal ganglia)

In general, we homo sapiens like to think we have evolved past this part of our brain, but this important part is integral to our survival. In a survival state, the primary question becomes: "Am I safe?" and is driven by instinctual awareness of threat, scarcity, and survival. Our reptilian brain uses the fight, flight, fawn, or freeze action to take when our safety is threatened. Fight is when we experience aggression, or a surge of adrenaline. Flight is when we avoid situations or run from the issue. Fawn is when we revert to people-pleasing behaviors. And Freeze is when we become immobile, unable to make movement toward a decision or situation. Think of a time this may have been applied to finances. Have you avoided checking your bank account, worried what the balance might say? Have you lashed out at a family member over an inheritance dispute? Or given beyond your means to avoid confrontation? Possibly just become stagnant in an important financial decision?

Maslow's hierarchy of needs and the triune brain

In another theory, Maslow's Hierarchy of Needs, we have food/shelter/safety at the base. When these needs are not met, it is hard to access the logical part of your brain. Often, one is placed into a fight, flight, fawn, or freeze mode when in situations where our food, shelter, and safety are threatened. As mentioned above, these modes may not look like physically running away from a predator, but more like being unable to open a utility bill or avoid paying down a credit card. When our basic needs go unmet for long periods of time, we can be in a constant state of fight, flight, fawn, or freeze. It can become our default setting, and recognizing certain response patterns can be hard to sense.

The societal system of chronic stress

Our current societal systems (work, school, healthcare, parenting, etc.) all cause a certain level of stress on the mind and body. Research shows that 53% of consumers say money is a source of stress, and our socioeconomic status and financial security can cause differing levels of stress that influence which part of the triune brain we are accessing. With chronic stress, we are purchasing from the emotional and reptilian brains.

Why retail therapy feels good (but doesn't last)

When we are under stress, not only are our decisions made from the emotional and primitive parts of our brain, but we are pleasure seeking. Individuals who find themselves in a shopaholic cycle are often seeking constant hits of pleasure for the brain. Without going deep into the science, dopamine is a hormone secreted in the brain in anticipation of a reward, which is often why the pleasure or excitement from anticipating the item wears off once we have it, and the satisfaction of having it loses its thrill. When we are not operating from the logical part of our brains, we can default to pleasure-seeking patterns to cope with stress, i.e., retail therapy. This is not a personal character flaw, but an adaptation by the nervous system seeking relief.

Please note that this is one small player in an entire symphony of aspects influencing purchase behaviors.

The pre-purchase pause that stops emotional spending

The first step to recognizing your emotional state when making purchases is pausing or slowing down to check in with yourself. Some questions you might ask yourself:

Body

How is my heart rate?

Am I hungry?

Emotion

Do I feel safe and secure?

How am I feeling?

What emotions are coming up?

Purpose

What is important about making this specific purchase?

What is the function of this purchase?

Values

How is this purchase aligned with my values?

How will this purchase impact my life 6 months from now? 1 year? 5 years? 10 years?

Take time to check in regularly and notice any patterns. Are you making new shoe purchases even though your closet is already full and you already own that functional style? How are you feeling at that moment? What is coming up? Are you noticing a pattern of feeling lonely in those situations? Are you in a space where you may be in your emotional brain instead of your logical brain?

Be kind to yourself

In closing, please know that there are a lot of things constantly influencing your stress levels, brain, and ultimately how you are making everyday decisions. If you find yourself in a constant state of stress, please seek professional assistance in stress management. Chronic stress not only impacts how you are mentally processing financial decisions, but also puts heavy strain on your cardiovascular system, limbic system, and more. With awareness and practice, it is possible to make financial decisions from a more regulated, values-aligned space.

If you need a guiding light to help you get started with building a budget or emergency fund, consider booking a session with a Mentor through your Fruition account. Having support in a judgement-free zone might be exactly what you need to make a positive change!

About the author

Stephanie Cote

CFEI®, CFEd®, Trauma of Money Certified Practitioner, HUD Housing Certified Counselor

Stephanie Cote is a financial educator, certified coach, and founder of Eagle Woman Soars LLC. She is a Certified Financial Education Instructor℠ (CFEI®), CFE Certified Financial Educator, and certified Trauma of Money professional. Stephanie brings a culturally grounded, strengths-based approach to financial mentoring, centering emotional well-being, community values, and long-term stability. Through Fruition and her consulting work, she supports individuals and families in building confidence, clarity, and generational resilience with money.